German government officials have welcomed proposals by the European Commission to boost net-zero industries and the competitiveness of European companies in an effort to keep up with other regions of the world, such as the U.S. and China. Parliamentary state secretary Franziska Brantner said a proposed legislation to ensure that the EU has access to critical raw materials it needs for climate neutral transformation is “very important and urgently needed.” The Commission also presented the Net-Zero Industry Act, which stipulates that at least 40 percent of key technologies like solar PV and wind power have to be manufactured domestically by 2030. The package is a response to the industry support given under the U.S. Inflation Reduction Act (IRA), but also to subsidies and regulation in other countries, such as China.

The German government has welcomed EU proposals to strengthen domestic industries necessary to make the bloc’s economy climate neutral by 2050, such as renewables, energy storage and carbon capture and storage (CCS). The European Commission laid out plans to secure sufficient amounts of critical raw materials needed for the transition, and stipulated a clean tech manufacturing target, saying 40 percent of key technologies like solar power and electrolysers must be home-made by 2030.

Brantner welcomed the raw materials act, saying it was “very important and urgently needed.” She greeted the fact that the Commission took up many of the German-French positions, saying “this gives a tailwind for our national efforts.” She called the Commission’s targets “very ambitious” but said that was a good thing.

Industry association BDI said the act sets the right targets but neglects the tools for successful implementation. “Europe needs to keep up and pace in the geopolitical race for critical strategic raw materials, but a much-needed funding offensive is missing from the CRM Act,” Wolfgang Niedermark, member of BDI’s executive board, said. He pointed to the fact that mining companies in the U.S. can write off ten percent of their costs under the IRA. “From the German industry’s point of view, this instrument is also worth emulating for Europe.”

The Commission presented the Critical Raw Materials Act, the Net-Zero Industry Act, plans for a European Hydrogen Bank, and proposals on long-term competitiveness (see details below) to “create a conducive regulatory environment for the net-zero industries and the competitiveness of European industry,” it said. Many of the proposals published today are part of the EU’s Green Deal Industrial Plan, which was presented in February in response to the U.S. IRA, but also to subsidies in other countries, such as China. The EU worries that key future technology industries could move to, set up or remain in other parts of the world to the detriment of EU industries. The U.S. had agreed the IRA, a landmark climate legislation that allows significant support for green tech companies producing in the United States.

While many welcomed the general push to support key domestic clean technology industries, politicians like former German European commissioner Günther Oettinger from the conservative CDU called the proposals “quite dangerous,” Politico reported. “It’s not a single market, it’s a planned economy more and more: a centralised, planned economy,” he said, adding that Europe should be about private investment, competition and competitiveness.

Net-Zero Industry Act

The Commission in February presented a policy package to “strengthen the competitiveness, attract investments in the net-zero industrial base and in green industrial innovation,” and today’s Net-Zero Industry Act is a key element. It aims to scale up manufacturing of clean technologies in the EU and make sure the Union is well-equipped for the clean energy transition, the Commission said in a press release.

“[The act] will create the best conditions for those sectors that are crucial for us to reach net-zero by 2050: technologies like wind turbines, heat pumps, solar panels, renewable hydrogen as well as CO2 storage,” Commission president Ursula von der Leyen said.

Key content of the Net-Zero Industry Act:

- Target for domestic manufacturing: provide >40% of EU’s annual deployment needs for strategic net-zero technologies by 2030

- The act defines as “strategic net-zero technologies”: solar PV & solar thermal; onshore wind and offshore renewable techs; battery/storage; heat pumps & geothermal; electrolysers & fuel cells; sustainable biogas/biomethane; CCS; grid techs

- Particular support + priority for projects with these technologies

- CCS: EU objective to reach annual 50Mt injection capacity in strategic CO2 storage sites in EU by 2030

- Requires public authorities to consider sustainability and resilience criteria for net-zero technologies in public procurement or auctions

- Sets up Net-Zero Industry Academies to ensure there is a skilled workforce

- Sets up Net-Zero Europe Platform to assist Commission and member states to coordinate action and exchange information

Critical Raw Materials Act

The proposal on critical raw materials aims to ensure that the EU will have access to those materials the bloc needs for the transformation to climate neutrality, such as lithium or nickel. Today, the EU relies heavily on a few countries. For example, the EU sources 97 percent of its magnesium in China, while heavy rare earth elements, used in permanent magnets, are exclusively refined in China, said the Commission. Sixty-three percent of the world’s cobalt, used in batteries, is extracted in the Democratic Republic of Congo, while 60 percent is refined in China.

“Raw materials are vital for manufacturing key technologies for our twin transition – like wind power generation, hydrogen storage or batteries,” von der Leyen said.

Key content of the Critical Raw Materials act:

- Aside from critical raw materials, it identifies a list of strategic raw materials (crucial for green transition, but subject to supply risks)

- Benchmarks for domestic capacities by 2030:

- At least 10% of the EU’s annual consumption for extraction

- At least 40% of the EU’s annual consumption for processing

- At least 15% of the EU’s annual consumption for recycling

- Not more than 65% of the Union’s annual consumption of each strategic raw material at any relevant stage of processing from a single third country

- Reduce red tape for projects in the EU

- EU will seek mutually beneficial partnerships with emerging markets and developing economies, notably in the framework of its Global Gateway strategy

- Member states must adopt and implement national measures to improve the collection of critical raw materials rich waste and ensure its recycling into secondary critical raw materials

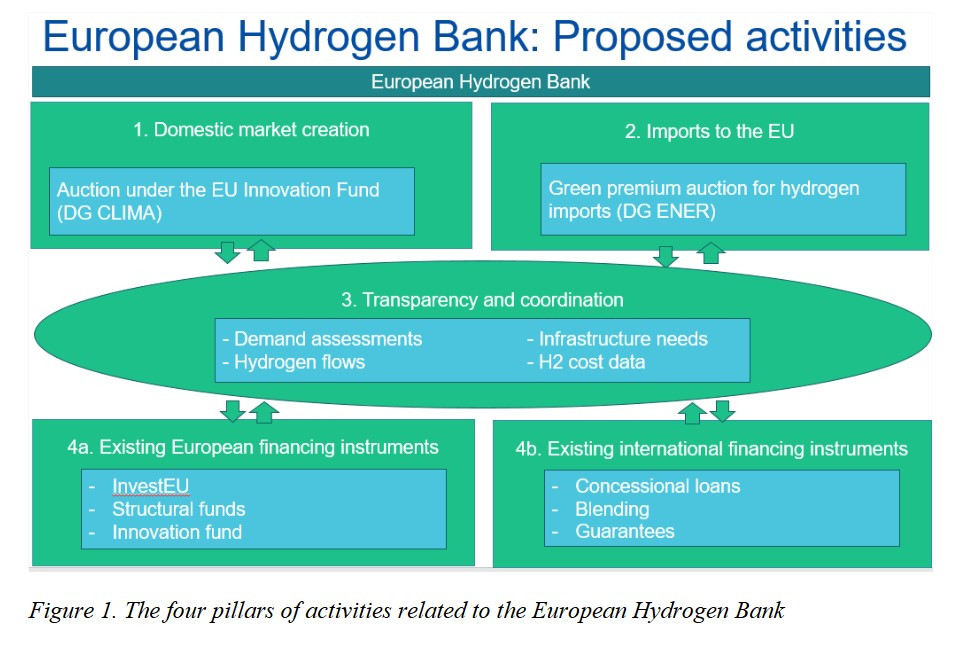

European Hydrogen Bank

The Commission also presented its plans for a European Hydrogen Bank, which would support the ramp-up of a market for renewables-based hydrogen within the EU and trade with international partners.

“By scaling up [green hydrogen] production, we will reduce the use of fossil fuels in European industries and serve the needs of hard-to-electrify sectors,” the Commission said.

Key features of the European Hydrogen Bank:

- Aims to unlock private investment in hydrogen value chains

- Cover and lower the cost gap between renewable hydrogen and fossil fuels for early projects

- De-risk hydrogen projects

- Play a coordination role and facilitate blending with the existing financial instruments at EU and national level

- Support the coordination of cooperation and trade with third countries

- First auction (€800 million) for renewable hydrogen production under Innovation Fund in autumn 2023

- Set up EU auction platform offering “auctions-as-a-service” for EU countries, using both the Innovation Fund and member state resources

Source: European Commission.

REACTIONS

Critical Raw Materials Act

Franziska Brantner, parliamentary state secretary at the economy and climate protection ministry (BMWK)

Brantner welcomed the act, saying it was “very important and urgently needed.” She greeted the fact that the Commission took up many of the German-French positions, saying “this gives a tailwind for our national efforts.” She called the Commission’s targets “very ambitious” but said that was a good thing.

Federation of German Industries (BDI)

The Germany industry association BDI said the act sets the right targets but neglects the tools for successful implementation. “Europe needs to keep up and pace in the geopolitical race for critical strategic raw materials, but a much-needed funding offensive is missing from the CRM Act,” said Wolfgang Niedermark, member of the executive board. He pointed to the fact that mining companies in the U.S. can write off ten percent of their costs under the Inflation Reduction Act (IRA). “From the German industry’s point of view, this instrument is also worth emulating for Europe.”

According to the association, the act can only succeed “if conflicting goals are resolved, location issues are clarified and a level playing field is created.” Aligning instruments with the U.S. would contribute to this, it said.

Environmental Action Germany (DUH)

NGO DUH said the initiative was “long overdue” but called for a stronger focus on resource efficiency and circular economy, as well as environmental protection and human rights standards. “In addition to recycling materials from old appliances and equipment, this includes above all a more efficient and economical use of resources,” DUH head Barbara Metz said.

For the strategy to be sustainable and effective, the law should be oriented more strongly towards the efficient use of resources and account for aspects such as durability, reparability and reuse, the NGO said, adding that support for such aspects does not come up enough in the draft law.

European Environmental Bureau (EEB)

The EEB welcomed the act but said it was deeply concerned about “the lack of robust due diligence language and the reliance on voluntary industry standards,” calling this “hardly reassuring” and “a free pass into industry self-regulation.”

NGO Transport and Environment

“This goal will help Europe end its reliance on Asia, but it is still missing a sufficient European climate finance plan to scale up production quickly,” the NGO said in a Twitter message. “The EU needs to send a clear signal that the future of its auto industry is electric,” it added.

Net-Zero Industry Act

European Environmental Bureau (EEB)

“It is neither necessary nor desirable that the race to net-zero becomes a race to the bottom on environmental standards,” secretary general at EEB Patrick ten Brink said. “The success of the EU’s industrial policy lies in its robust regulation and carbon pricing—and policymakers should not be fooled by comparisons to the U.S. context, where power, but not guaranteed efficiency, lies in subsidies alone.”

The main areas of concern for the environmental organisation are spending too much money on technologies that haven’t proven their readiness (such as carbon capture, utilisation and storage — CCUS — and small nuclear reactors), prioritising speed at the cost of public participation and due diligence and a lack of attention to wider environmental impacts.

Michael Bloss, climate policy spokesperson for the Greens in the European Parliament

“We must now set the course for 100 percent renewable energies and not make any gifts to the nuclear industry,” Bloss said, adding that the technology was expensive, unreliable and there was no final repository in sight, therefore there was no place for it on the climate industry act. “Solar and wind power plants, heat pumps and e-cars – these are the technologies of the future. Therein lies the future of European industry,” he said.

Günther Oettinger, former European commissioner from Germany’s conservative CDU

“This direction is quite dangerous,” Oettinger said referring to central planning by the EU, Politico reports. “It’s not a single market, it’s a planned economy more and more: a centralised, planned economy,” he added, saying that Europe was about private investment, competition and competitiveness.

Felix Schenuit, researcher at SWP Berlin

Schenuit said the proposal to have a CO2 injection capacity target to increase carbon storage sites within the EU would “affect the CCS debates in member states substantially.”

Source: Clean Energy Wire